This copyright car loan is an efficient option for founded businesses who need to have to buy new or made use of autos for each day use.

This Wells Fargo line of credit rating gives aggressive fees for businesses with at the least two decades in Procedure.

It’s essential to Evaluate and distinction a business loan vs. a line of credit. You will discover key variations concerning these two business financing selections, together with:

At this point, you should have a good comprehension of how the SBA 504 loan system works as well as costs, conditions, and quantities you'll be able to expect to acquire with this particular funding.

Loan guarantees are what give personal lenders The arrogance to offer SBAs with reduced payments plus more flexible phrases.

Pupil loans guideFAFSA and federal university student aidPaying for occupation trainingPaying for collegePaying for graduate schoolRepaying student debtRefinancing college student debtBest private college student loans

For that reason, lots of the terms and rates you’ll see in relation to this SBA loan program (which we’ll talk about all over this information) refer especially to the CDC part of the loan.

One example is, should you’re planning to utilize a SBA 504 loan to acquire, renovate, or change an current building, it needs to be a minimum of 51% proprietor-occupied. For that reason, when you had 504 SBA loan Reno been getting a building with 5 Place of work spaces, you would manage to lease out two of These Areas even though occupying the remaining 3 Areas.

Provided this Extraordinary aid that's available for existing and new conventional SBA 7(a) and 504 borrowers, it's important that borrowers and lenders examine selections for conventional SBA loans all through this period of time.

Each lender has its own software course of action. To generally be authorised, you might need to deliver essential facts, which include money statements and tax returns, and also your credit score and business license.

Funding choices for qualified business owners incorporate SBA loans, lender loans, time period loans, business traces of credit score and gear funding. You sometimes need a calendar year or more of business historical past and revenue to qualify for financing.

Using the bank part of the loan, On the flip side, the curiosity charge you receive will depend upon the individual lender as well as your business’s skills.

Small business lenders use quite a lot of information from the corporation to determine if they will lend into the owner. Usually, lenders want To make sure there’s significantly less risk with the nonpayment on the loan. To get that information, the lender may possibly take a look at a wide array of information, including the economic documents of the corporate, gain and reduction statements, revenue, and balance sheets.

Daniel Stern Then & Now!

Daniel Stern Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Bill Murray Then & Now!

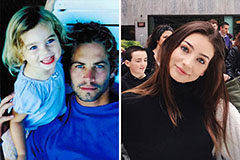

Bill Murray Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!